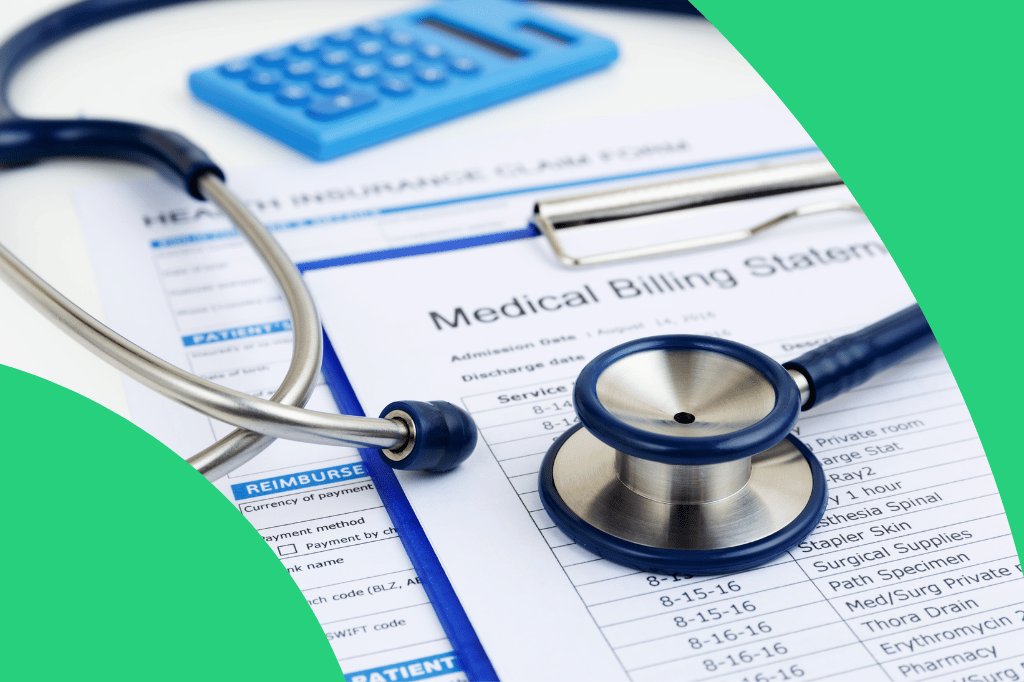

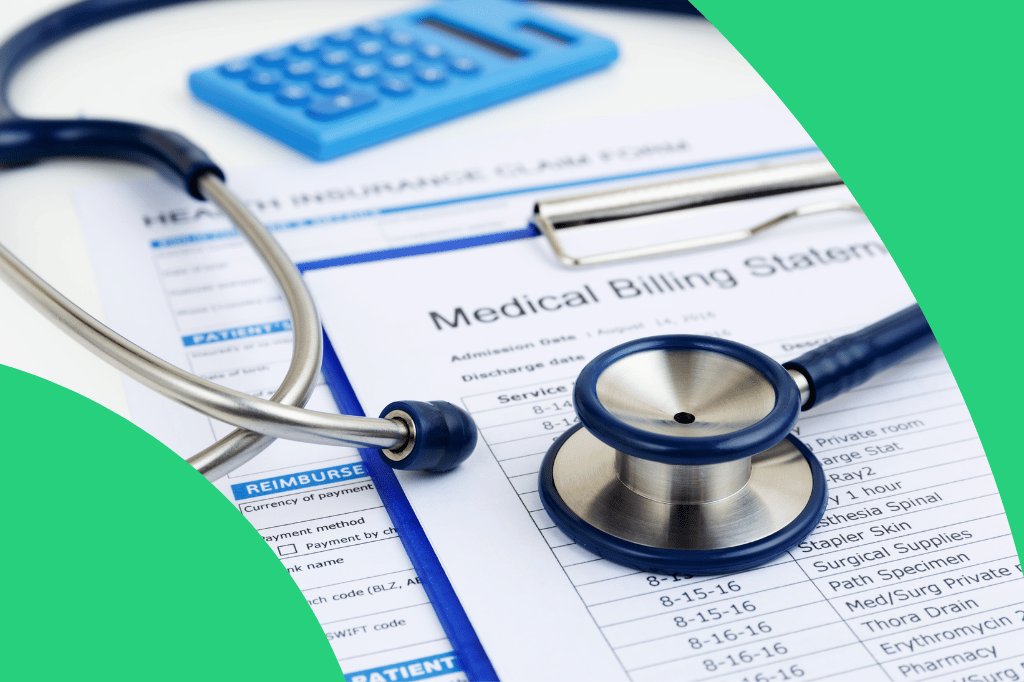

Predict | Propensity to Pay

Predict propensity to pay and optimize collection.

With more than one-third of Americans reporting that an unexpected medical bill greater than $100 would push them into debt, healthcare organizations are grappling with increasing payment collection difficulties, major margin reductions, and a significant loss of revenue. In 2018, $12 million was the average amount of uncompensated care reported by hospitals, and this figure is expected to grow.

BUILT FOR HEALTHCARE

Ingest, normalize, and blend data

from dozens of health data sources.

Electronic Health Records

Unstructured Clinical Notes

e-Prescribing Data

Vital Signs

Remote Monitoring Data

Medical Claims

Rx Claims

ADT Records

Lab Test Results

Social Needs Assessments

Social Determinants of Health

Operations & Services

Likelihood that patient bill will not be paid in the next six months

Patient ID

Gender

Age

Risk Score Percentile

239851110

Female

37

98

Impact on risk

Contributing factor

Value

Uninsured Children Percentage Measure

30%

# of Avoidable ER Visits (12M)

3

# of Missed / Rescheduled Appts (12M)

3

Reported Barriers to Care

Transportation

AI INFORMS ACTION

Pinpoint high-risk individuals and surface actionable risk factors.

ClosedLoop generates explainable predictions using thousands of auto-generated, clinically relevant contributing factors.

Support

Support patients with financial literature

Identify

Identify patients likely to qualify for benefits

Direct

Direct patients to appropriate care settings for their unique needs and circumstances

EXPLORE MORE USE CASES

Serious Fall-Related Injuries

Reduce fall-related injuries and improve functional support.